History in the digital age is prone to unique dangers. How can we ensure the accuracy of our future history?

Across the globe, pilot studies for a new form of currency have begun. Taking inspiration from successful decentralized digital currencies like Bitcoin, Central Bank Digital Currencies (CBDCs) will soon become a reality. CBDCs are not like cryptocurrencies that most people know of, they are polar opposites. CBDCs as part of the name will be centralized and programmable, not decentralized and public. These currencies are initially being marketed as an alternative to cash, not a replacement. But the dangers of this new currency are not being discussed by the unelected global governments campaigning for them, such as the World Economic Forum (WEF) and Bank for International Settlements (BIS).

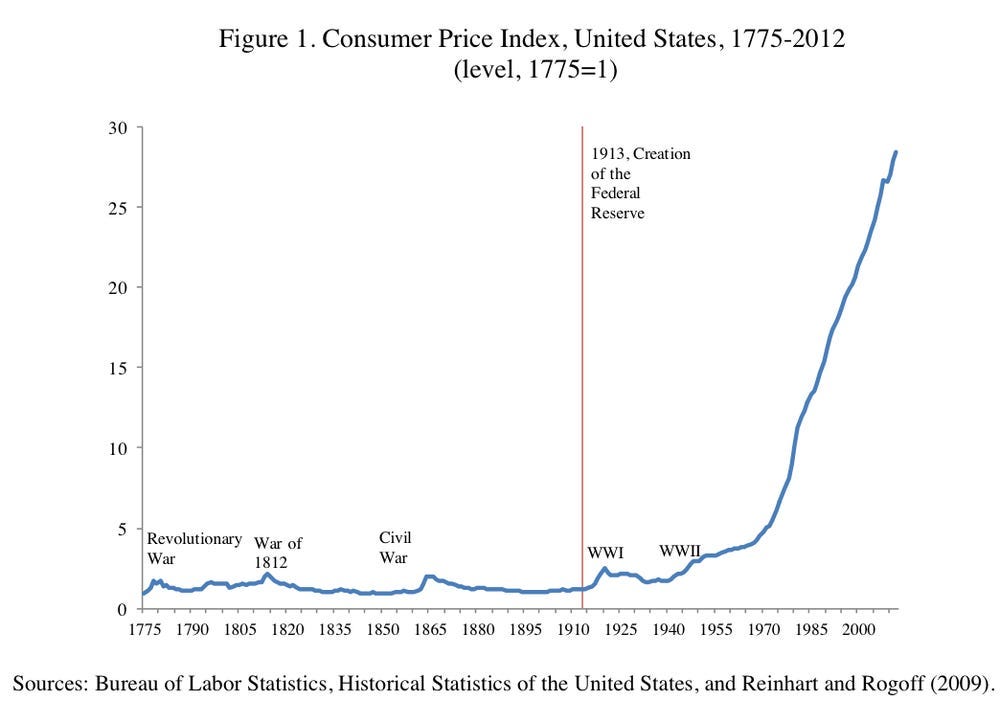

The first step in understanding CBDCs is to understand what the Central bank is. Almost every major country has a central bank or reserve, used to back the commercial banks which loan and store money for the people. The United States moved away from the traditional Gold Standard- money backed by gold-in 1971 for a “fiat currency, or a currency that depends on faith in the Federal Reserve.” The Federal Reserve, AKA the Fed in the United States, was created in 1913-after a couple of failed attempts-by a group of wealthy bankers and politicians, including J.P Morgan, Henry Davidson, Frank Vanderflip, Paul Warburg, Abraham Andrew, and Nelson Aldrich, during a secret meeting off the coast of Georgia. The “Federal” Reserve is actually a private institution, not controlled by the government. Americans have always feared federal banks and reserves; Thomas Jefferson said, “I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around(these banks) will deprive the people of all property until their children wake up homeless on the continent their fathers conquered.” On his death bed Andrew Jackson said “I killed the bank” when asked what his greatest accomplishment was. From the creation of the Fed in 1913 to the end of the gold standard in 1971, inflation rose at 309.1% rate, and from 1971 to 2023, it rose by an estimated 659.7% rate; from 1913 to 2023, inflation has increased an estimated rate of 3007.8% total-before the creation of the bank, $1 was worth about $31 today.

Since the dollar is not backed up by a tangible commodity, the Fed can-indirectly-print as much money as it wants. The Fed prints money and loans it with interest to commercial banks and the government, meaning every dollar carries debt immediately. As inflation rises, money means less, driving up the need for credit cards and putting money back into the banker’s pockets.

Currently, the Federal (Central) Bank does not loan to the people directly. Instead, the Fed gives money to commercial banks, which lend money directly to individuals. With the implementation of a CBDC, the Fed will have total control over money, which may eliminate the need for commercial banks entirely- the Fed will get all the profits. CBDCs will also eliminate one’s right to privacy since, as General Manager of the BIS Agustin Carstens says, “In cash, we don’t know, for example, who is using a $100 bill today, who is using a 1000 peso bill today. A key difference with the CBDC is the central bank will have absolute control over the rules and regulations that will determine the use of that expression of central bank liability, and we will have the technology to enforce that.” The central bank will not only be able to monitor all purchases but also have “absolute control over the rules and regulations that will determine the use.” For example the proposed holding limit “of around 3,000 to 4,000 digital euro per capita.” and while a digital Euro “would complement cash but not replace it” efforts have already been made to reduce the role of physical cash in countries such as France (1000 cash Euro transaction limit), Italy (1000), Greece (500) and a surprising number of others. The central bank and government are proposing that for a transaction to be private, it must not exceed 50 euros, and the individual must not spend more than 1,000 euros monthly. In the U.S., a CBDC would be “identity verified” and “not anonymous.”

Policymakers such as the German Minister of Finance Christian Linder has called for CBDCs to be “programable,” leaving many fearful for the freezing of funds similar to what was seen in Canada during the freedom convoys. Programmable currency gives the government or the wealthy bankers-who are not voted for-the ability to freeze, fine, or degrade the “money” they give individuals if they, for example, support an opposing political ideology, attend a protest they don’t like, exceed their carbon allowance, want to buy unhealthy food or go to a non government approved store, or are accused of spreading “misinformation” on social media-an action already seen from PayPal. Discussions of preventing the spending of money have been had, Tom Mutton a director at the Bank of England said “There could be some socially beneficial outcomes from that, preventing activity which is seen to be socially harmful in some way.” Without strict definition of these “socially harmful” behaviors the introduction, and eventual total take over of CBDCs is the beginning of what could-eventually-become a social credit score system.

Almost every major country is seriously discussing the implementation of technology like this soon (Full list here as of 2022). In 2022, President Biden issued an executive order calling for “responsible development of digital assets.” Also in 2022, the New York Fed launched a 12-week pilot program. The Boston Fed has been researching the “opportunities and limitations of possible technologies for CBDCs” in association with the Massachusetts Institute of Technology for multiple years known as the Hamilton Report. The technologies in question likely include blockchain-AKA Distributed Ledger Technology (DLT)-used by Bitcoin and is essentially a collection of records linked with each other and stored on multiple computers. This makes the blockchain very hard to alter-or program-and is also protected via cryptography (video explanation of blockchain). The Hamilton Report found that “a distributed ledger operating under the jurisdiction of different actors was not needed to achieve our goals.” (Summary of Hamiltion Report.) Other technologies like Payment Interface Providers (PIP), Smart Contracts, and many other models with varying levels of centralization are also being considered.

While people may tell you that CBDCs will be good for cross-border payments, inclusion for the un(der)banked, efficiency and various other reasons. It is impossible to deny the risks presented by CBDCs. While the current system is flawed-primarily due to the actions of the Fed-handing, more control to the central banks and governments is not the answer. CBDCs are the future, but there is still-a small amount of-time to force a digital constitution of rights or for the people to fight to regain control of their own currencies.

This piece solely expresses the opinion of the author and not necessarily the organisation as a whole. Students For Liberty is committed to facilitating a broad dialogue for liberty, representing a variety of opinions. If you’re interested in presenting your perspective on this blog, click here to send us your own piece submission!