Current debates surrounding the potential legalisation of cannabis show the frustratingly slow pace of liberalisation in Europe. No national government seems ready to fully commit; the UK refuses to discuss recreational weed, while Italy won’t allow for any stronger strains to be sold legally. Even in the Netherlands, the ‘front door open, back door closed’ policy, whereby coffeeshops can legally sell small amounts of cannabis to consumers but cannot purchase it from producers, continues to cause confusion, and holds back the market from reaching its full potential.

The market for cannabis itself is nonetheless thriving. As one of the most widely-used illegal drugs in Europe, the cultivation, trade, and consumption of marijuana continues to operate as in any other market, only with production, consumption, and sale happening underground. Legislation against cannabis has not seen much success in curbing the market, rather it has diverted the benefits of growth away from consumers and legitimate producers.

State measures against cannabis are a costly measure against a potentially vibrant market. Whether the state is reluctant to liberalise fully, or if measures remain deliberately restrictive, there is simply no logic in continuing to reject the benefits of the cannabis market.

Neither Here, Nor There

Although many European countries seem to be gradually edging towards liberalisation, the glacial pace at which this is being carried out continues to dampen prospects. For example, Italy, who’s neither here-nor-there approach to cannabis legalisation has resulted in a vague, scattered market, continues to deter investment and growth through unclear legislation. The Bruno Leoni Institute describe this approach as ‘the law of yes, no, maybe’ in their recent report. Currently, Italian consumers are permitted to buy ‘cannabis light’, usually hemp flowers, which contain less than 0.2% THC. However, the law does not permit these flowers to be consumed, nor does it allow for legally-sold seeds to be cultivated. Thus, the Italian cannabis market exists in a strange state of limbo between liberalisation and prohibition.

Similarly, in the UK, the government is discussing taking a more liberal stance on medical marijuana, but has made clear that it will not consider legalising the drug for recreational use. Despite this, the UK already has a large cannabis market. The Institute of Economic Affairs (IEA) estimates the value of the British cannabis market to be around £2.55 Billion, based on the UN’s 2017 world drug reports estimate of a £10-per-gram street price, and an overall volume of 255 tonnes of marijuana being sold in 2016/17. Moreover, the report suggests that the British state would stand to save around £300 million in law enforcement and healthcare costs should the drug be legalised.

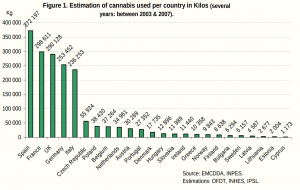

As both the UK and Italy are amongst the top five for cannabis consumption in Europe, as the graph below demonstrates, it is made even more apparent that attempts to hold down the market through prohibition have been futile. Rather than continuing with this failed approach, opting for legalisation and the ending of the black market would be beneficial in terms of savings to the state, consumer protection, and increased investment.

As the graph shows, the benefits of the market for marijuana must not be limited to Italy and the UK, however. The European Cannabis Report, produced and published by Prohibition Partners in November 2017, values the European market for medical marijuana at around €35.7 billion, with the recreational market not too far behind at €32.5 billion. Moreover, the data presented in the report further implies that this value is growing, despite legal ambiguity and restrictions. More committed liberalisation and clear legislation promises benefits not only to the nations of Europe, but to the continent as a whole.

Looking West

A role-model for cannabis liberalisation can be found in North America, as Canada begins to reap the rewards of its tolerant approach to the drug. Set to become the second country in the World to legalise recreational marijuana on October 17th this year, this movement towards liberalism is already resulting in new opportunities for investors and entrepreneurs, and cannabis, at C$3 billion (€1.95 billion) in 2017, is already on-par with beer, and has overtaken tobacco in terms of market value. Moreover, the market is already growing. Sales of dried cannabis in Canada have been increasing at around 6% per month, while the market for cannabis oil has grown at 16% per month.

Canada’s willingness to commit to liberalisation has resulted in the re-shifting of the economic benefits of the cannabis market away from black market dealers, and back into the hands and pockets of consumers and legitimate producers. Moreover, the Canadian government (i.e. taxpayer) is now set to save, as money previously spent policing marijuana may now be used elsewhere. The exact amount may be estimated at around C$444 million, based on data from 2001, when the evidence for the exact amounts spent on marijuana were clearest.

The nations of Europe should look to the northwest for a roadmap to sensible cannabis liberalisation. If countries such as the UK and Italy can follow in Canada’s footsteps, they will avoid missing out on a new ‘green-rush’, save money on reduced law enforcement, and see that the benefits of the market go to the right place.

This piece solely expresses the opinion of the author and not necessarily the organisation as a whole. Students For Liberty is committed to facilitating a broad dialogue for liberty, representing a variety of opinions. If you’re a student interested in presenting your perspective on this blog, click here to submit a guest post!

Image: Pixabay